Exploring the Rule Symposium 2024: A Journey into Natural Resource Investing

- Rachelle Thielman

- Jul 9, 2024

- 4 min read

The Rule Symposium on Natural Resource Investing 2024 has officially kicked off, and it has been an eventful start. The symposium began on Sunday with an exciting registration and reception. Companies had the opportunity to set up their booths, engage with investors and prospects, and showcase their projects and plans. We made sure to visit some of these booths where we had the chance to gather valuable information.

Yesterday marked the second day of this prestigious symposium, which was all about gold mining. CEOs and representatives from various companies took the stage to delve into their projects, strategies, financial health, and more. Here’s a detailed look at the companies that presented and the topics they covered.

The day began with opening remarks by Rick Rule, setting the stage for the day's discussions and presentations. Rick Rule, founder of Sprott and still its largest shareholder, emphasized the importance of being a contrarian investor and seeking big themes before they arrive. He advised investors to look for the price to value variance, scaling opportunities, and management quality when evaluating mining companies. He concluded with the principle that one should never take profit if the asset or company is still undervalued.

Peter Behncke of Gold Royalty followed with a presentation on the company's impressive growth since its founding in 2020. He discussed the historical gold price adjusted for inflation and projected a return to levels seen in the 1980s. Gold Royalty boasts a high-quality portfolio, with a focus on growing NAV and cash flow. The company has 7 cash-flowing assets and is close to breaking into positive free cash flow. With strong backing from Gold Mining and a trading valuation at 0.60x NAV (compared to the industry average of 1.2x NAV), Gold Royalty is positioned for significant growth.

Ross McElroy, President & CEO of Fission Uranium Corp., highlighted the strength of the uranium sector, describing it as the strongest it has ever been. He shared insights from his 40 years of industry experience and mentioned that Paladin Energy is looking to purchase Fission Uranium with a 30% premium through shares.

Dr. Nomi Prins delivered a keynote on "The Real Asset Big Bang," discussing the current state of the US banking system, rising delinquency levels, and the increasing appeal of gold. She noted that gold is a go-to asset for central banks and investors looking to diversify against the dollar. Dr. Prins also mentioned the potential for silver prices to rise due to increased demand from central banks and energy policies.

Dr. Nomi Prins

Brien Lundin of Gold Newsletter offered a historical perspective on gold prices adjusted for inflation, predicting continued gains even if the Fed starts lowering rates. He emphasized the importance of real yields pushing gold prices and noted the absence of Western buying in the current market.

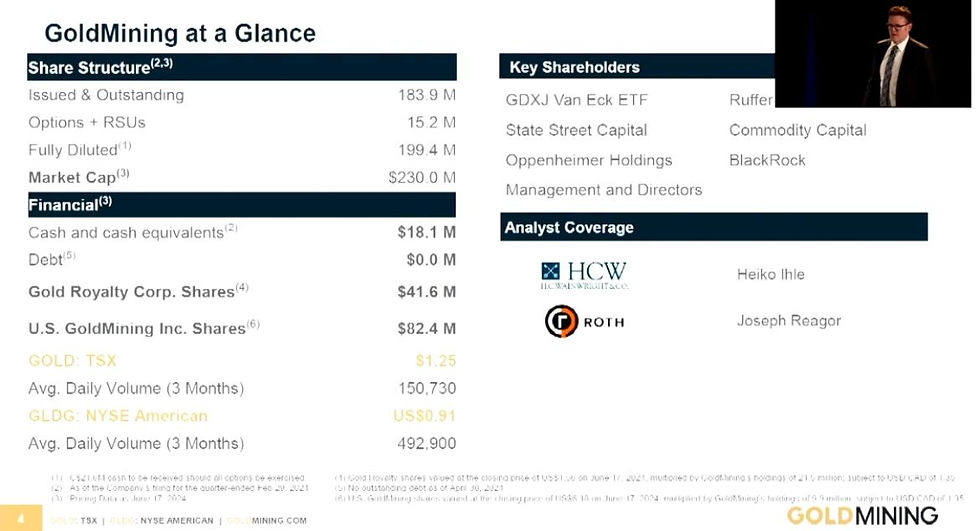

Alastair Still of GoldMining Inc. provided an overview of the company's strong balance sheet and deep resources, with projects primarily in the Americas. GoldMining Inc. is focused on sustainable mining and is actively seeking a joint venture or spin-out for its large uranium deposit.

Rudi Fronk of Seabridge Gold highlighted the company's 25-year track record of outperforming gold and other gold stocks. He emphasized the need for more copper due to the energy transition and shared his bullish outlook on gold and copper. Stay tuned for a more in-depth interview video with Rudi Fronk.

Alexandra Woodyer Sherron, CEO & President of Empress Royalty, discussed the company's attractive valuation, management team's significant ownership stake, and the potential for exponential growth. Empress Royalty is trading at a 73% discount to free cash flow, making it an appealing investment opportunity.

During the lunch break, we joined a sponsored lunch presentation in Grand Salon J. Introduced by Shae Russell, Jason Kosec, President, CEO & Director of Integra Resources, presented on "Building the Next Great Basin Producer." Jason Kosec, with over ten years of experience in mineral exploration, mine development, and investor relations, shared his insights and vision for Integra Resources. His background includes significant roles at Trelawney Mining and Exploration, IAMGOLD, and Barkerville Gold Mines, showcasing his extensive expertise in the industry.

After lunch, Joseph Cavatoni, Market Strategist at the World Gold Council, provided insights into the factors driving gold prices, including risk and uncertainty, opportunity cost, and momentum. David M. Cole, President & CEO of EMX Royalty Corp., followed with a discussion on the company's strategy to be exposed to all minerals that offer royalty streams.

Darren Gordon, Managing Director of Centaurus Metals Ltd., spoke about delivering a new generation of reliable, low-carbon nickel supply from Brazil. Professor Joel Litman of Valens Research highlighted the US's economic profit leadership and the benefits of its global tax system. He argued that GDP is not a reliable metric for creditworthiness, emphasizing the importance of economic profit.

Graham Harris, Chairman & Director of Surge Battery Metals, and Albert Lu, President of Luma Financial, rounded out the day's presentations with insights into their respective companies and the broader market dynamics.

A Strong Foundation for Investment Decisions

The first two days of the Rule Symposium have laid a strong foundation for informed investment decisions in the natural resources sector. From economic outlooks to company-specific insights, attendees gained valuable perspectives from leading figures across the industry.

With Day 3 on the horizon, the symposium promises to deliver even more valuable content, especially as we explore the silver mining industry. Stay tuned for further updates, including a video featuring Shernel's reflections on the event, and get ready to delve deeper into the exciting world of natural resource investing.

Stay tuned for a more in-depth interview video with Rudi Fronk and more content and updates!

Comments